Pensioner Homeowner principal residence exemption

Pensioner Homeowner principal residence exemption for one land Title

The DVA and Centrelink homeowner principal residence exemption applies only to your principal residence and the first two hectares of land covered by the single land Title that your home is on.

For pension assessment purposes, your assets include real estate on additional land Titles apart from the first two hectares of the allotment that your home stands on. Any more land that you own is to be included in your assets for DVA or Centrelink means testing.

Homeowner for pension assessments

Pensioner Means Testing forms include questions about your home.

The DSP Age Pension and DVA Pension application forms ask if you own a home and how big is the land that your home is on.

If you live in a home that you own then for pension purposes you would normally be treated as a ‘homeowner’ and your principal residence could be an ‘exempt asset’.

You could also be a pensioner homeowner if you paid a substantial ingoing amount for the right to occupy, or lease, an apartment or independent living unit in retirement lifestyle community.

When the capital improved value of your home or your ingoing contribution to a retirement lifestyle living community, is less than $146,500 (at January 2015) then you could ask to be treated as a “non-homeowner” pensioner and have the value of your home, or ingoing contribution, included as an Asset.

Pensioner Homeowner principal residence exemption for two hectares only

Centrelink allows the land lot that your principal residence sits on to be treated as an ‘exempt asset’ when you are a ‘homeowner’ customer. But if the land lot that your home sits on is larger than two hectares the excess land counts as an asset. Special conditions apply to some retired farmers who are still on the land that they worked.

For pension Asset Test purposes, the ‘value’ of the excess part of the land that your principal residence stands on is calculated on a pro-rata basis using the site value for the whole allotment.

For example if your principal residence stands on three hectares of land then the first two hectares are exempt but the additional one hectare of your land area is counted as an Asset; if the whole allotment has a site value of $240,000 then the excess one hectare would be valued for Asset Test purposes at $80,000, one third of the value of the total land .

Pensioner Homeowner principal residence exemption for one land Title only

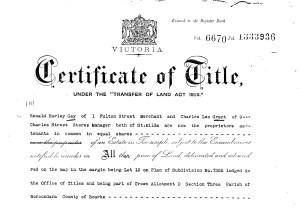

The principal residence exemption for a pensioner homeowner is only for the land covered by a single Title.

If your home sits on the land covered by one land Title and your garden, tennis court or hobby farm is covered by another land Title then the land covered by the additional Titles is not normally exempt.

Your holiday house, the city apartment you own for your student son to live in, and your investment properties also count as assets at Centrelink and DVA.

Centrelink and DVA expect you to declare all of your additional land Titles whenever you are completing the Asset part of a Centrelink means testing form.

Pensioner Homeowner exemption for one principal residence only

You cannot have more than one principal residence at any time. You cannot count both the ‘town house’ and the ‘beach house’ as your principal residence. ‘Couples at Centrelink’ are only allowed one principal residence for the couple not one per person.

Any additional real estate needs to be declared to DVA or Centrelink for means testing purposes.

Aged care means tested fees and pensioner Homeowner principal residence exemption

Centrelink undertake the Means Tested Fee assessment for all Commonwealth supported aged care.

The principal residence exemption continues when the former home of an aged care resident continues to be the principal residence of the aged care resident’s partner or another Commonwealth funded Pensioner.

Aged care means tested fees and accommodation prices are complex.

Christine at Financial Care Services understands the Centrelink assessment of the means tested amount for aged care both home care and aged care.

Assistance with completing the Centrelink aged care asset and income means testing forms is available to clients of Financial Care Services.

A consultation with Financial Care Services helps you understand your potential and aged care costs together with the DVA and Centrelink implications of rearranging your assets or selling the former home.

Call Christine on 03 9808 0338 to make an appointment for a consultation.

Pensioner homeowner exemption in retirement lifetime planning with Financial Care Services

Christine at Financial Care Services engages with clients approaching retirement to consider their retirement finances. Upgrading your principal residence and your alternative home could be part of your retirement plans. Creating your dream retirement home could involve large emotional and financial commitments.

Before you make those commitments consider where will be your principal residence for DVA and Centrelink.

Planning your major expenditure and budgeting your ongoing retirement lifestyle outgoings helps you live within your means and avoid debt in retirement.

Call Christine on 03 9808 0338 to book an appointment to discuss your long term lifetime planning for when you work from home.

Financial Care Services is an independent advisory service specialising in retirees of modest means and aged care entrants.

Financial Care Services charges fees based on the work involved in advising you.

Christine at Financial Care Services understands both the DVA and Centrelink Pensions systems and the Commonwealth aged care fee arrangements.

A consultation with Financial Care Services helps you understand your potential retirement living costs together with the DVA and Centrelink implications of rearranging your assets or changing your principal residence.

Call Christine on 03 9808 0338 to make an appointment for a consultation.

Financial Care Services does not base fees on the value of your assets nor do we accept any commissions or payments from other service providers.

For confidential, independent and professional advice about DVA, Centrelink, lifestyle or aged care issues please book an appointment with Christine Hopper by calling 03 9808 0338 or email your enquiry.

Disclaimer: The information contained in this website is of a general nature only and does not constitute “financial advice”.

© 2015 Financial Care Services Pty Ltd. All rights reserved.