Centrelink Pension Loans Scheme

Centrelink Pension Loans Scheme

The Centrelink Pension Loans Scheme is available to part Pensioners whose Pension amounts are reduced on account of either the Asset Test or the Income Test but not both. Permanent Australian residents who have attained Age Pension Age but are excluded from the Age Pension by either of the Income Test or the Assets Test, are also eligible for the Centrelink Pension Loans Scheme.

Consider Bob and Betty, many years ago Bob and Betty bought a beach block and built a basic holiday house. The beach house is still used regularly by the now elderly Age Pensioners Bob and Betty. Bob and Betty hope to bequeath the beach house to their children as it has always been their summer playground.

At Centrelink, the value of the beach house counts as an Asset of Bob and Betty for the Age Pension Asset Test. The beach block has appreciated in value such that Bob and Betty receive only partial Age Pensions.

Bob and Betty have only a small amount in the bank and no income apart from their part Age Pensions. The part Age Pensions does not provide enough income to cover the couple’s modest lifestyle and the costs of owning the beach house.

Bob and Betty apply for the Centrelink Pension Loans Scheme. Centrelink agree to paying the full Couples rate of Age Pension to Bob and Betty, the increase in their Age Pension payment rates is being ‘loaned’ to them by Centrelink. Bob and Betty have entered into a loan agreement with Centrelink, the loan is secured against Bob and Betty’s suburban home, not against the beach house.

When Bob and Betty pass on their family home will need to be sold to payout the loan to Centrelink before their estate is shared among their children. The children could then receive the beach house as an inheritance.

Who can borrow under the Centrelink Pension Loans Scheme

You must satisfy all of the residency conditions for a Centrelink Pension before you could qualify for the Centrelink Pension Loans Scheme. In addition, you must have attained your Age Pension Age, or satisfied the ‘permanent disability’ criteria for Disability Support Pension or the special conditions for the Carer or Wife Pension.

To qualify for the Centrelink Pension Loans Scheme, you must have satisfied all of the conditions for a Centrelink Pension and then be excluded or have your Pension payment reduced, by one but not both of the Income Test and the Asset Test.

Consider Bob and Betty their only income is about $260 per year, that is, $10 per fortnight, of interest and the Age Pension. But their Age Pensions are reduced by $450 per fortnight by the Assets Test. Bob and Betty could use the Centrelink Pension Loans Scheme to borrow $450 per fortnight and have the equivalent of the full Age Pension paid into their bank account by Centrelink.

Then consider Joe, who retired from his full time teaching role but likes to do emergency relief work in his former school.

Joe has ‘financial assets’ of $750,000 including his superannuation fund balance. Joe owns his home plus a good car and quality household goods. Thus Joe’s assets exceed the Age Pension cut-off of $722,800 for the Single Age Pension in April 2015.

The deemed income on Joe’s financial assets was $23,655 per year and his work income was about $35,000 for the last year. After allowing for any ‘work bonus’ Joe’s assessable income at Centrelink exceeds the cut-off for any Age Pension of $1,722.40 per fortnight, $44,782 per year. Thus at age 70 years Joe is excluded from the Age Pension by both the Asset Test and the income Test and thus Joe is ineligible for the Centrelink Pension Loans Scheme.

For the Centrelink Pension Loans Scheme, potential borrowers must be impacted by only one of the means tests not both.

How much can be borrowed under the Centrelink Pension Loans Scheme

The maximum amount that could be paid to a participant in the Centrelink Pension Loans Scheme is the full rate of Pension applicable to the borrower.

Centrelink might not allow you to borrow the full ‘gap’ between the full Age Pension rate and your Age Pension entitlement if the outstanding balance on your Centrelink Pension Loan looked too high compared with the value of the property that you gave as security for your Centrelink Pension Loan.

Consider Cathy who lives alone in a fashionable suburb. Cathy has retained both the family home and the adjacent land that accommodates her additional garden. Centrelink value the additional garden land, at $700,000 so that Cathy is excluded from any Age Pension by the Asset Test.

Cathy wants to ‘borrow’ the full amount of the Age Pension $860.20 per fortnight, from the Centrelink Pension Loans Scheme. Centrelink might allow the very elderly Cathy to borrow the full Age Pension amount for the final few years of her life.

Bob and Betty had their Age Pension reduced by the Asset Test but remained entitled to small part Age Pensions. Bob and Betty could ask to have the full Couple rate of Age Pension paid to each of them. They would be ‘borrowing’ the gap between their part Age Pensions and the full Couple rate of Age Pension that they are receiving. Centrelink might consider that the beach block would increase in value sufficiently to support the loan that Bob and Betty request.

Consider Jim who owns a small “weekender” place in a remote recreational fishing spot jointly with his three brothers. The four sons inherited the land from their father so all four names are on the Title.

Jim’s public service pension reduces his Age Pension entitlement so he asked about the Centrelink Pension Loans Scheme. Centrelink refused to grant Jim a loan because his one quarter share of the value of the holiday place was too low.

Fees for the Centrelink Pension Loans Scheme

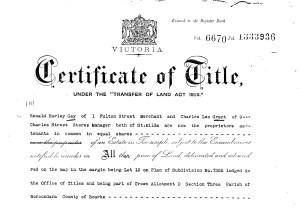

Centrelink charges administration fees for setting up an account under the Pension Loans Scheme and registering a mortgage against the Title of property offered as security for the loan.

All costs associated with establishing, changing and finalising the loan, such as legal and solicitor costs, are the Pensioner/borrower’s responsibility. Centrelink will send a letter when the loan has been established, to advise the amount of set-up costs to be recovered from the Pensioner/borrower.

The loan applicant/Pensioner can choose to pay these set-up costs immediately from their other financial resources. Alternatively Centrelink could add the set-up costs to the outstanding loan balance.

Interest on loans under the Centrelink Pension Loans Scheme

Interest is charged fortnightly on the outstanding loan balance of a Centrelink Pension Loan. The rate of interest charged is determined by the Commonwealth as at 11 May 2015 the interest rate was on 5.25% compounding fortnightly. The interest rate could change at any time.

The interest rate is applied to the outstanding loan balance each fortnight. Interest continues to accrue until the loan is repaid. Thus the accruing interest increases the amount to be repaid.

The outstanding loan balance consists of the principal loan amount, plus accrued interest, plus any outstanding costs, less any repayments made.

Other changes to your account under the Centrelink Pension Loans Scheme

Centrelink reviews the amount of Age Pension or DSP payable to each Pensioner every time the Pension rates and/or the means testing Allowances are changed by the Commonwealth.

Your Pension entitlement is also reviewed whenever you inform Centrelink that your circumstances or asset and income position has changed. If your Pension entitlement changes or the maximum rate of Age Pension changes then Centrelink will review the amount of your fortnightly loan drawdown.

Centrelink would also review your Centrelink Pension Loans Scheme payment regularly to ensure that the value of your Centrelink Pension Loans Scheme balance is reasonable compared with the value of the property securing your loan.

Repaying the debt under the Centrelink Pension Loans Scheme

A loan under the Centrelink Pension Loans Scheme can be repaid in part or full at any time.

For example, if Bob inherited some money from his brother, Bob and Betty could pay-off part of their loan.

The loan may also be repaid from the Centrelink borrower’s estate or the estate of a surviving partner after the death of a Pensioner borrower.

Remember that Centrelink would register a mortgage over the property used as security for any Centrelink Pension Loans Scheme debt. Therefore if you wish to sell the real estate that is used as security for the loan, you need to have the mortgage cleared before the sale could be finalised.

As the first step in arranging the sale of the property, the borrower or the executors of their Will, must contact Centrelink about the Centrelink Pension Loans Scheme debt. The Centrelink Pension Loans Scheme debt must be repaid at the time of the sale to provide the Title to the new owners.

Centrelink Pension Loans Scheme could change for future borrowers.

The Centrelink Pension Loans Scheme conditions and interest rate could be changed at any time. You need to check the latest details before applying for the Centrelink Pension Loans Scheme.

Seek Independent Advice about Centrelink payments

Financial Care Services is an independent advisory service specialising in aged care entrants and Centrelink Pensions.

Christine at Financial Care Services understands both the DVA and Centrelink Pensions systems and the Commonwealth aged care fee arrangements.

To book a consultation appointment for confidential, independent and professional advice about Centrelink, aged care costs or strategic lifestyle issues please contact Christine Hopper at Financial Care Services 03 9808 0338.

Financial Care Services is a fee-for-service practice. Clients of Financial Care Services pay fees for personal financial factual information consultations and general advice.

Disclaimer:

The information contained in this website is of a general nature only and does not constitute “financial advice”.

All eligibility for Commonwealth benefits will be determined by Centrelink or DVA, based on your personal position as documented and the legislation and Regulations in force at that time.

© 2015 Financial Care Services Pty Ltd. All rights reserved.

To make an appointment for professional advice, call Financial Care Services 03 9808 0338